If the fiscal year end is different from the calendar year end, then the filing due date is on the 15th day of the 4th month after the fiscal year end. Deadline with extension: October 17, 2022. Deadline with extension: September 15, 2022.Ĭ corporations deadline: April 18, 2022. Deadline with extension: September 15, 2022. Just like sole proprietors, you still have to may estimated tax payments by the usual filing deadline that corresponds with your business type:

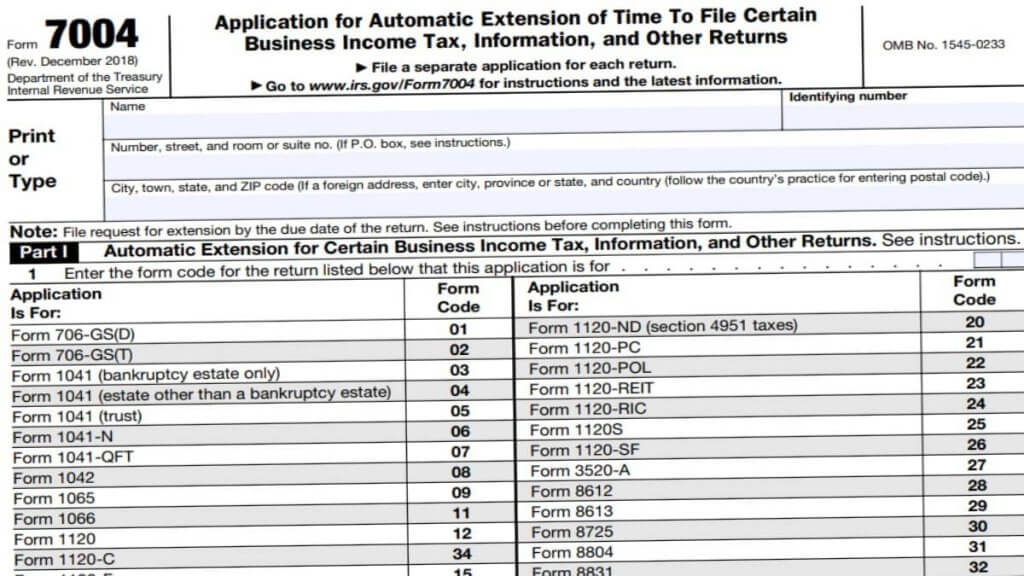

Rather than filing a paper form, you’re likely better off using the IRS’ e-file service. If you have your information handy.įor all corporations and partnerships, you’ll need to complete Form 7004 for an extension on filing your taxes.

Partnerships, S corps, and C corps: here’s how you file for an extension online Once you submit your application for the extension, your tax return filing deadline will automatically be moved to October 17, 2022. You need to apply for a tax extension on or before the usual tax deadline of April 18, 2022. So to file for an extension, you’ll also need to estimate your total taxes owed (here’s a guide to calculating your small business taxes) and subtract the total amount of tax you’ve already paid. Remember, you’ll still need to pay your taxes by the Apdeadline.

#Irs online 2016 tax extension request free#

If your income is below $72,000 you can use Free File software, but if your income is above $72,000 you’ll have to settle for the Free File fillable forms. The IRS offers a few tools to do this online. To file for a tax extension separate from paying your taxes online, you’ll need to fill out IRS Form 4868. You’ll still need to provide your basic contact and tax information, but you won’t need to file for an extension and pay your taxes as two separate steps.įiling for an extension online (time: <30 minutes) Your six-month extension will begin right away, no need to apply for anything.Īlso, filing online and setting up direct deposit for your bank account is the fastest way to get your tax refund, even if you’re filing with an extension. Rather than going through the IRS Free File system (more on that below), you can just select the “extension” option when paying through the IRS payment portal. This is by far the fastest, simplest way to get an extension on tax filing. If you plan on paying your taxes online, you can get an automatic six-month extension without filling out any other forms. File by paying electronically (time: <5 minutes) You’ll have tax due six months after your normal filing date.įor everyone else, to receive an extension, you must submit an application for automatic extension. If any of these exceptions apply, you’ll automatically receive an extension of time to file your tax return-you do not need to file for the extension. citizen living in parts of the country that have been hit by severe natural disasters

#Irs online 2016 tax extension request how to#

But before we get into how to avoid late filing penalties, you should know there might be a chance you don’t need to file for an extension at all. Sole proprietors: here’s how you file for an extension onlineįiling for a sole proprietorship or self-employed extension, you’ll follow virtually the same steps it takes to file a personal tax return.

0 kommentar(er)

0 kommentar(er)